The Big Bank Venture

Build a new bank that retains & grows the customer base within RBS group.

Mark Bailie - RBS COO

Client

RBS

Company

Fjord

Role

Design Lead

Duration

18 months

We found

People are bad with their money

We are naturally terrible at managing our own money. So much so, that just under half of us in the UK spend what we earn and on average, have just 2 weeks worth of savings.

& the relationship is broken

People simply don’t trust their bank and it's easy to see why. Unclear products and impersonal advice leave customers feeling neglected.

You know that banks just aren’t on your side.

A new way of banking

So we built a new bank from the ground up to redraw the lines of what a bank can be.

Taking insights from qualitative research, we leveraged anonymised RBS customer to data validate behaviours that often prevent people from living a more financially sustainable life.

800k

existing RBS customer data

200+

qualitative interviews

See it in action

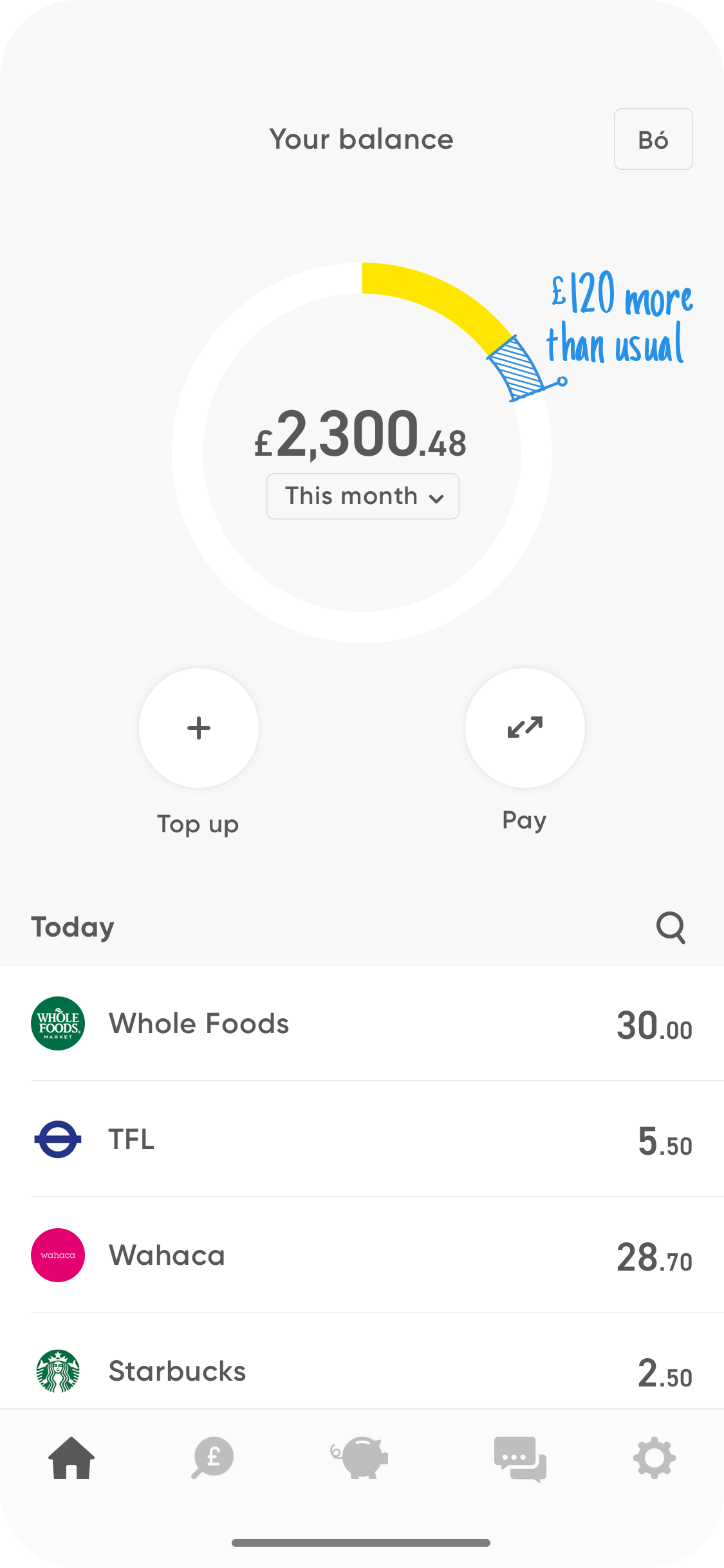

Keeping it simple

The launch product is purposefully simple. Prioritising features that provide the biggest impact for our audience in their day-to-day lives.

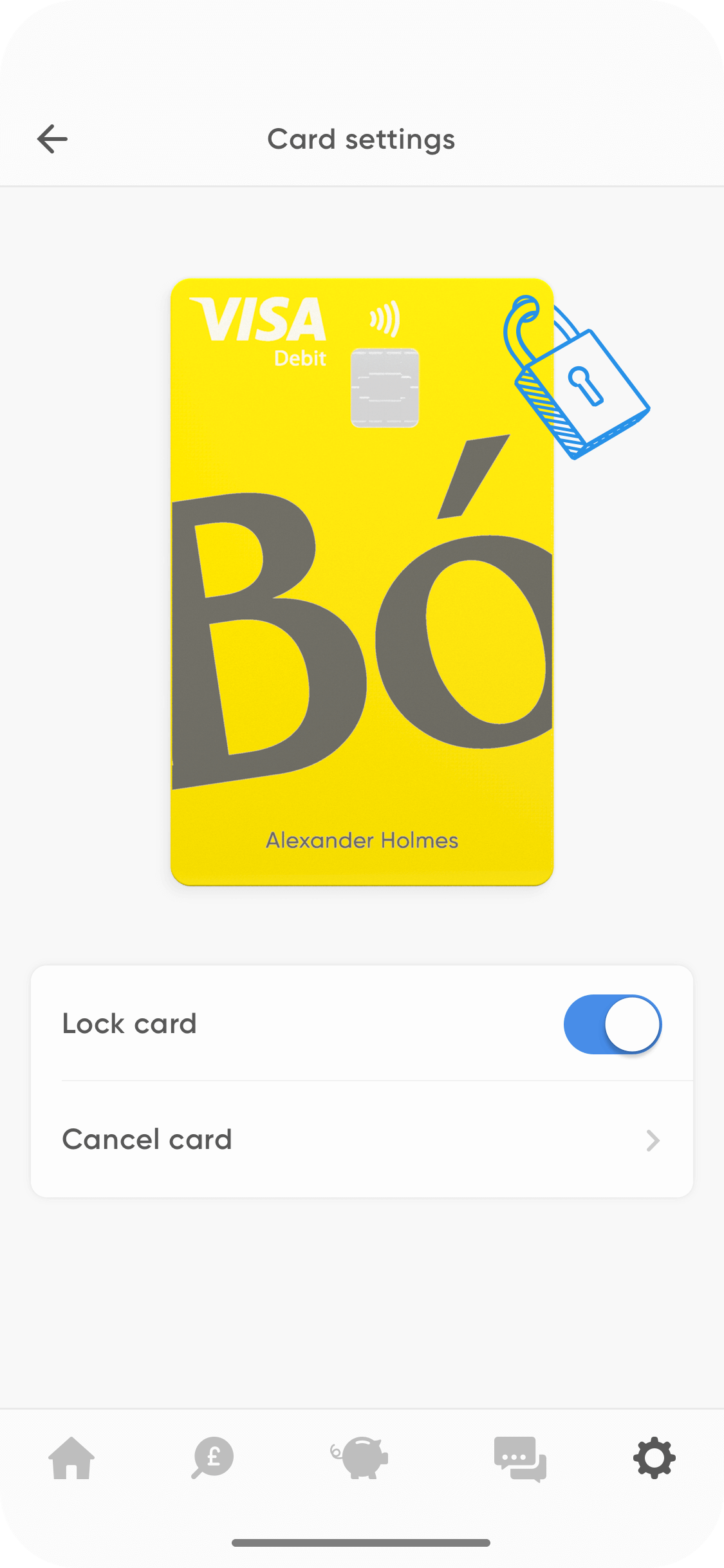

These include: Instant payment notifications, transaction detail, categorisation of spend, simple payments, disable card and around the clock support.

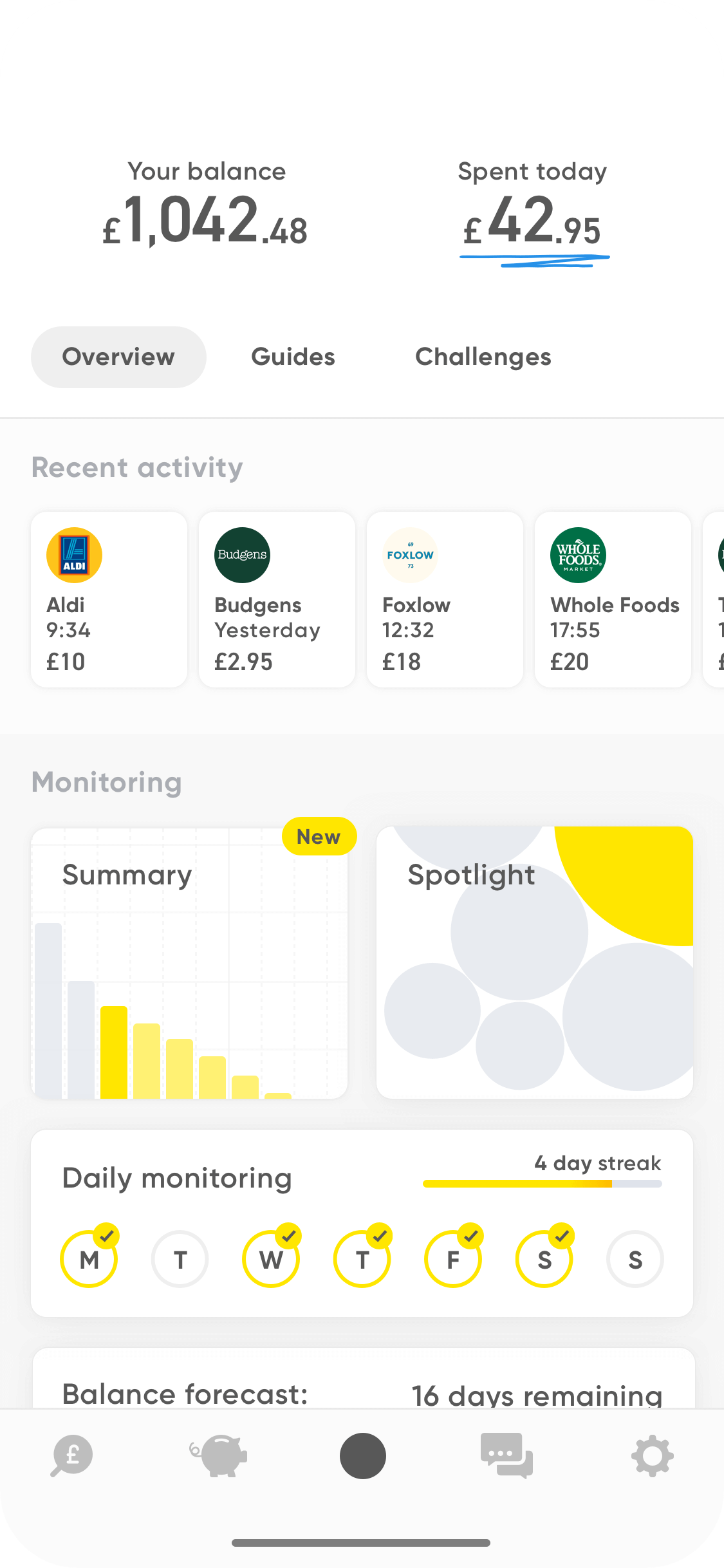

Home

Finances at a glance

When launching the app, customers can view their current balance and most recent transactions. As a realtime service, the numbers displayed are always a true representation of their finances. A huge benefit for countless research participants who are frequently caught out by delayed transactions appearing unexpectedly.

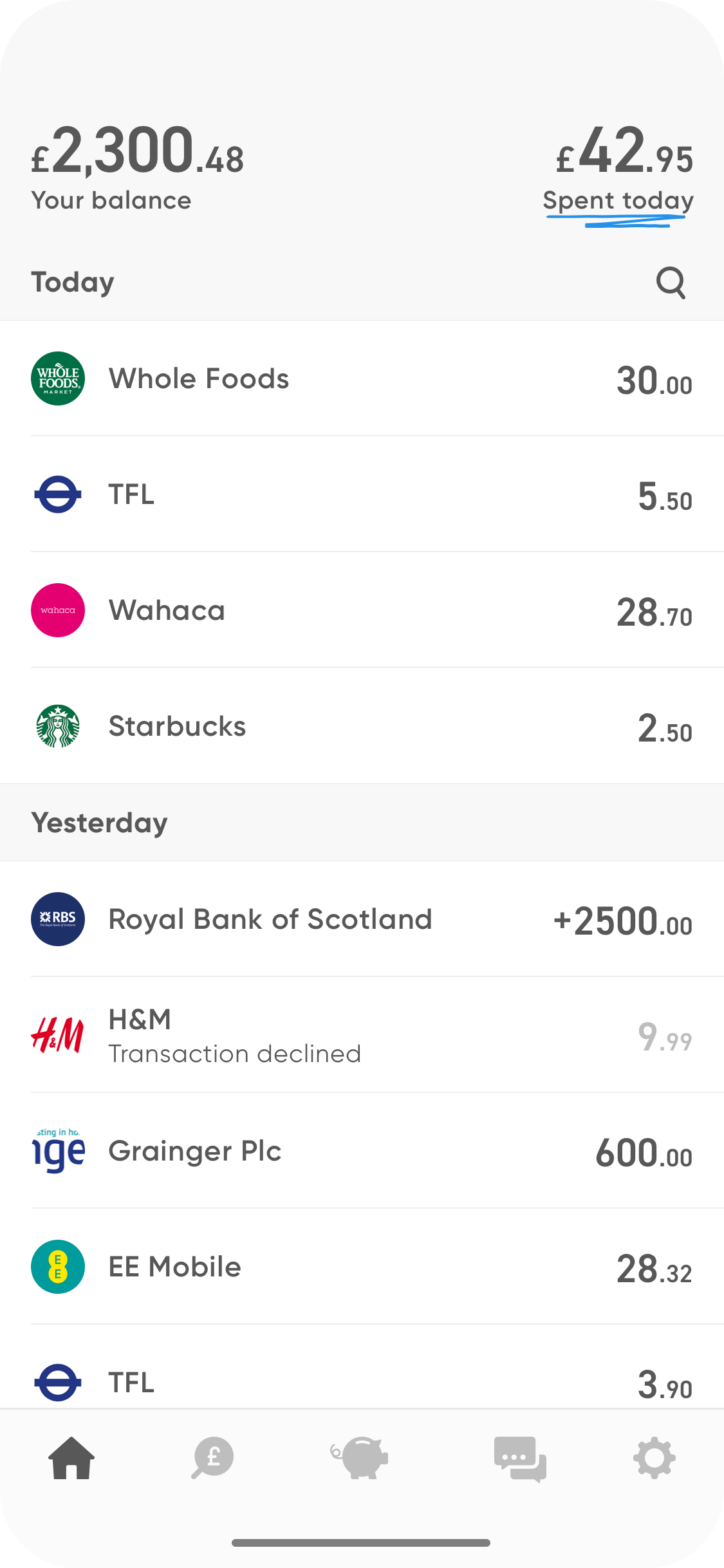

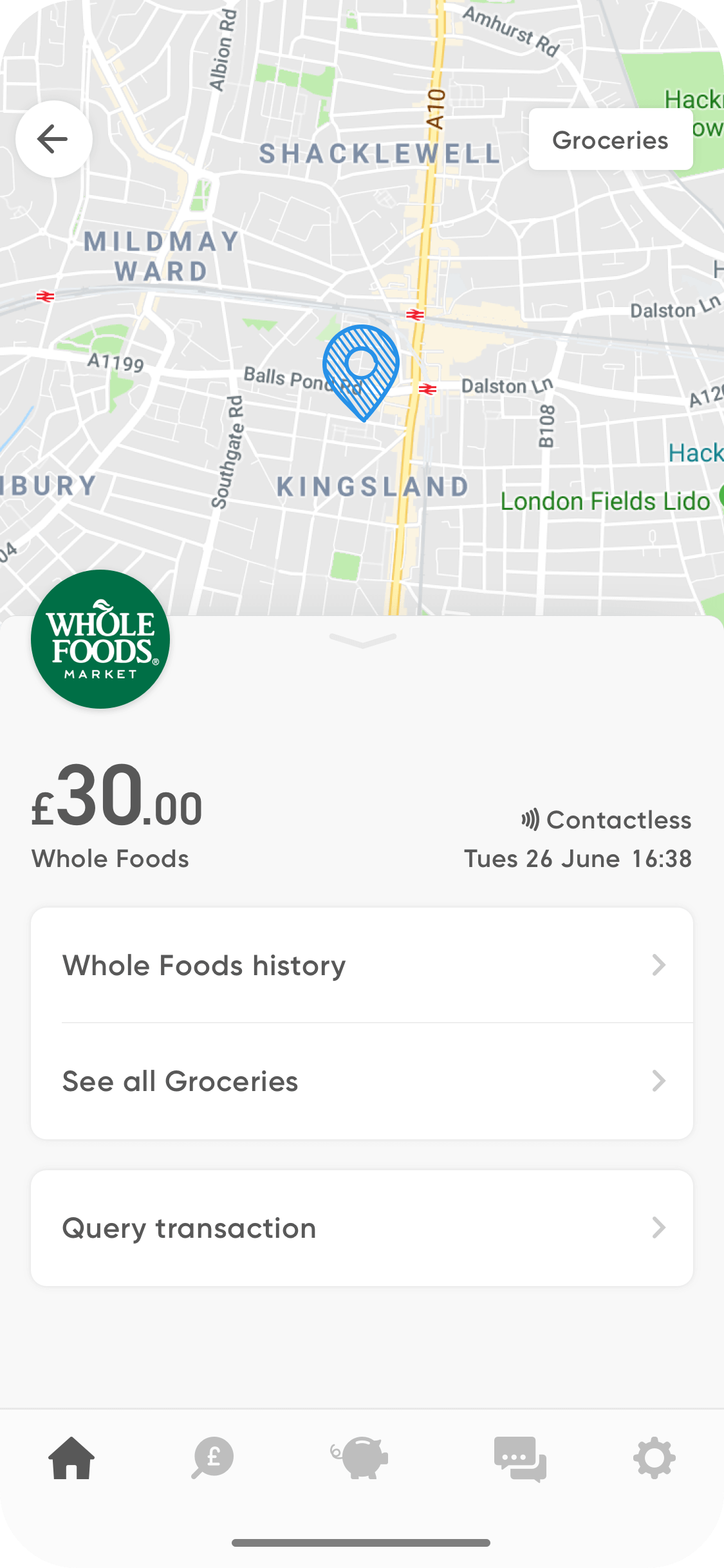

Transactions

Transaction details

Each transaction from the homepage directs to a dedicated transaction detail page where customers can view the amount, location and time of the transaction.

Actions also allow the customer to view similar transactions by merchant or category.

Insights

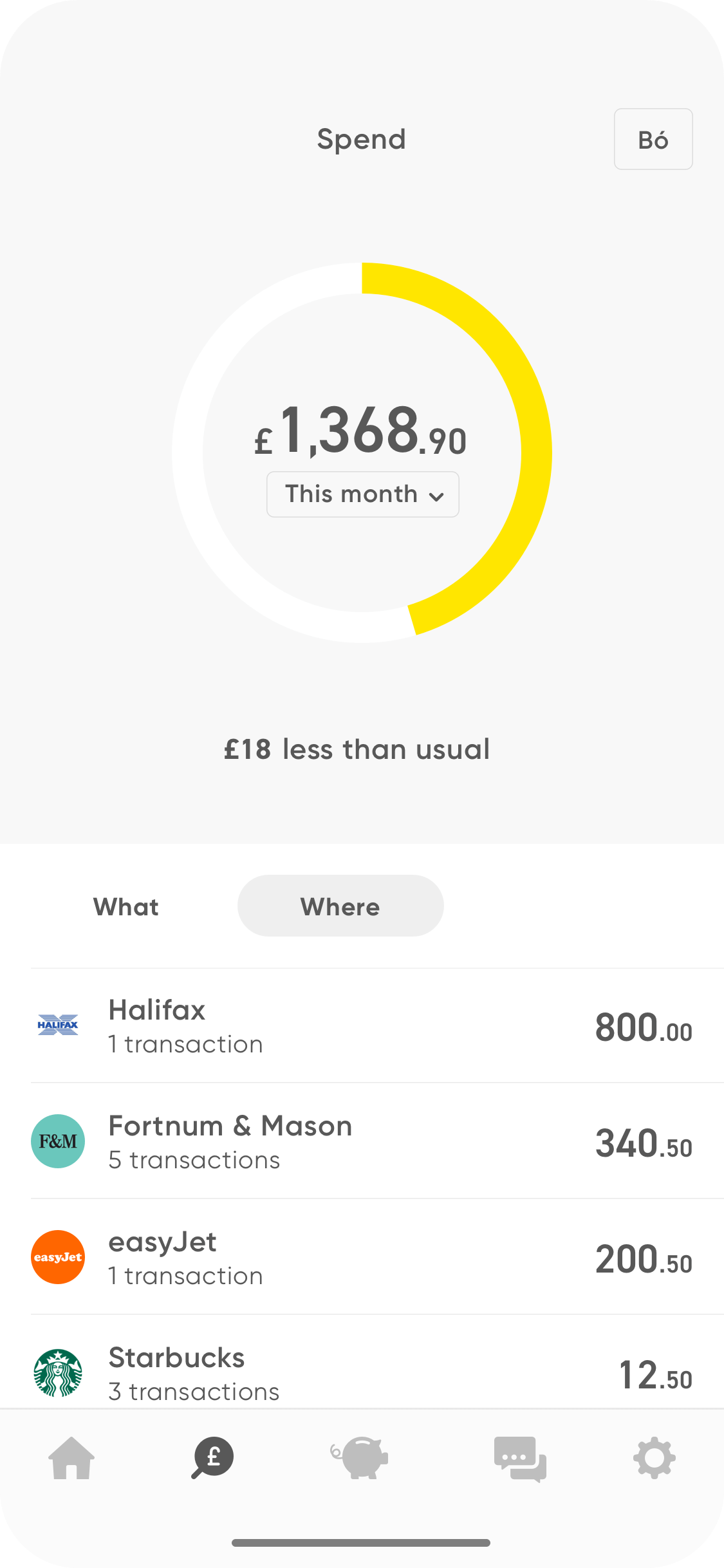

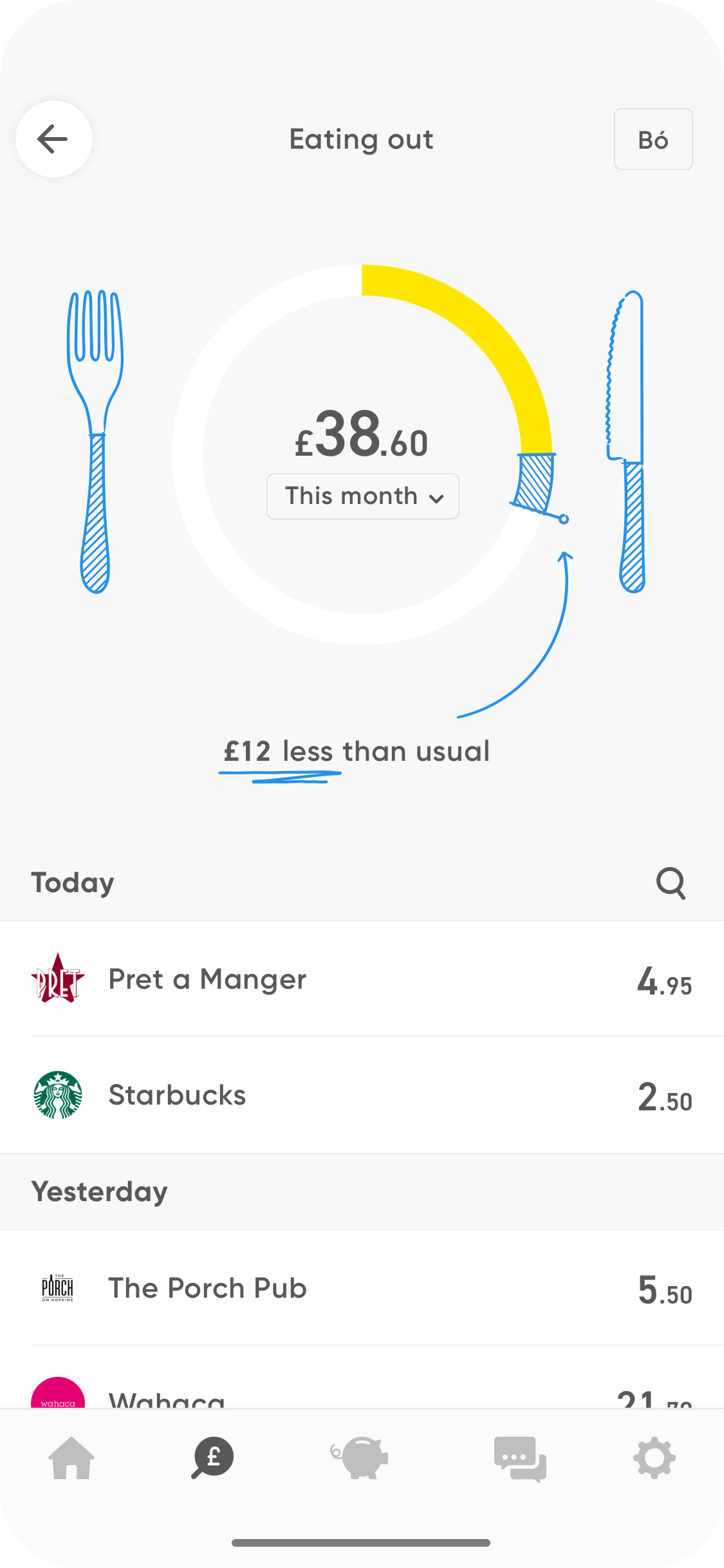

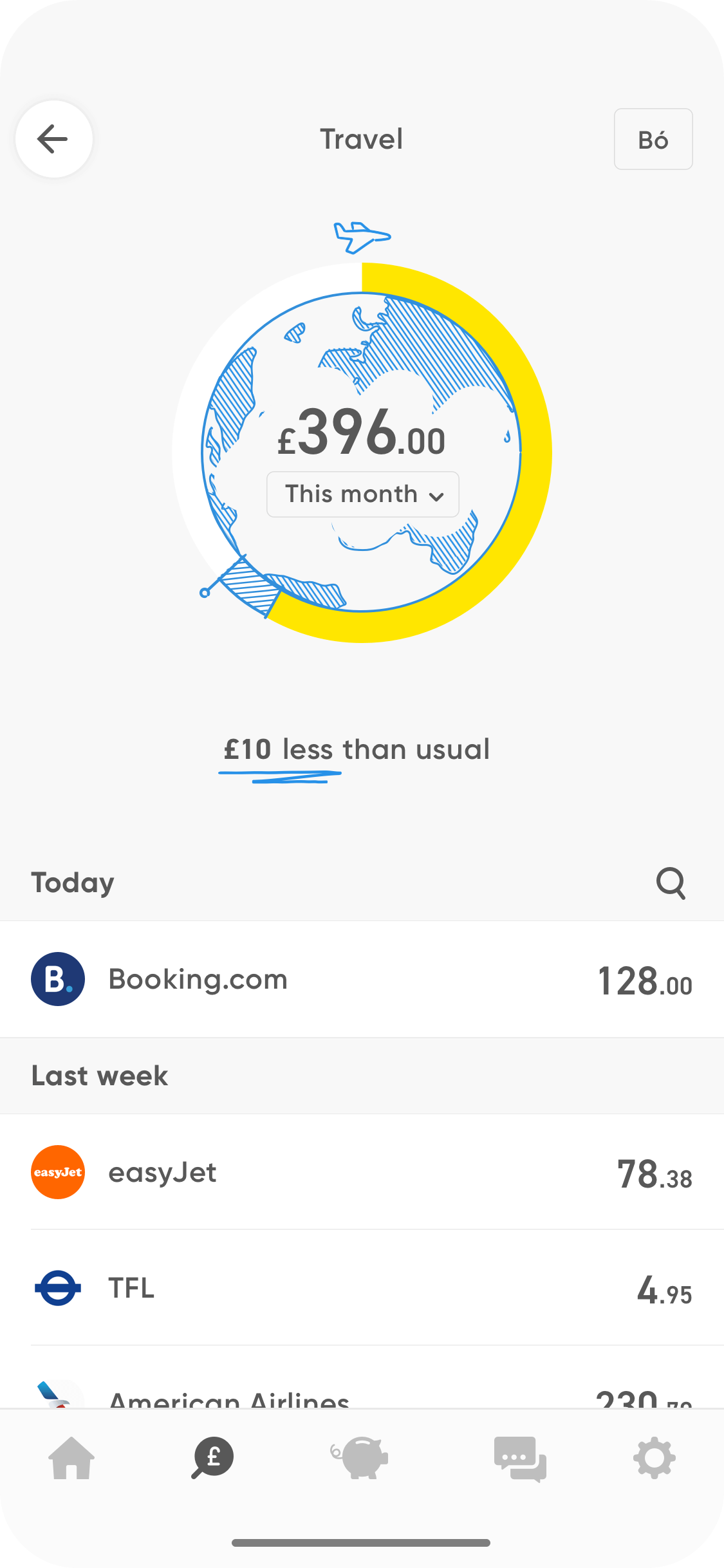

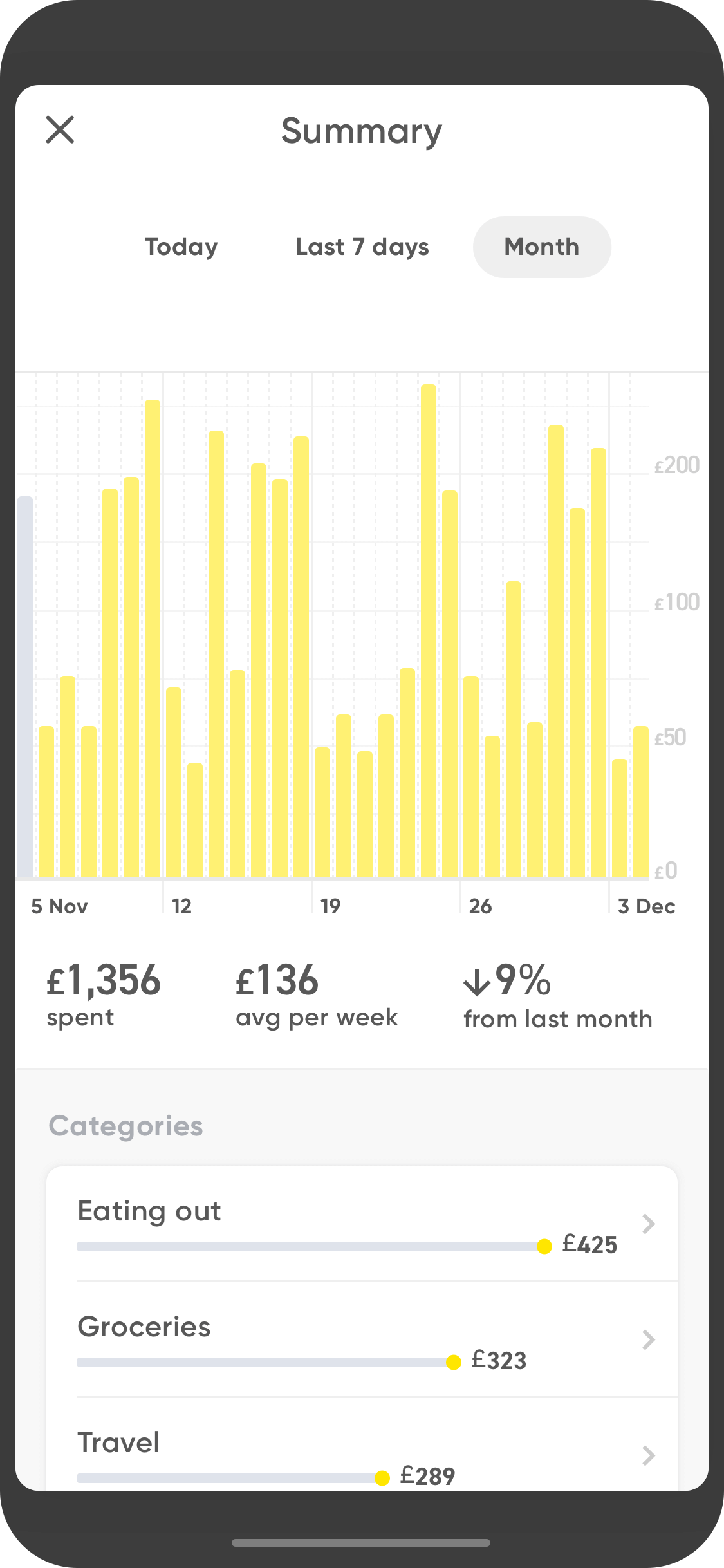

Spend categorisation

In the insights tab, customers can view their spending behaviour broken down by categories. Bo leverages individual’s transactional data to deliver these insights.

Never telling them how to spend their money, but empowering them to make more educated spending decisions.

Payments

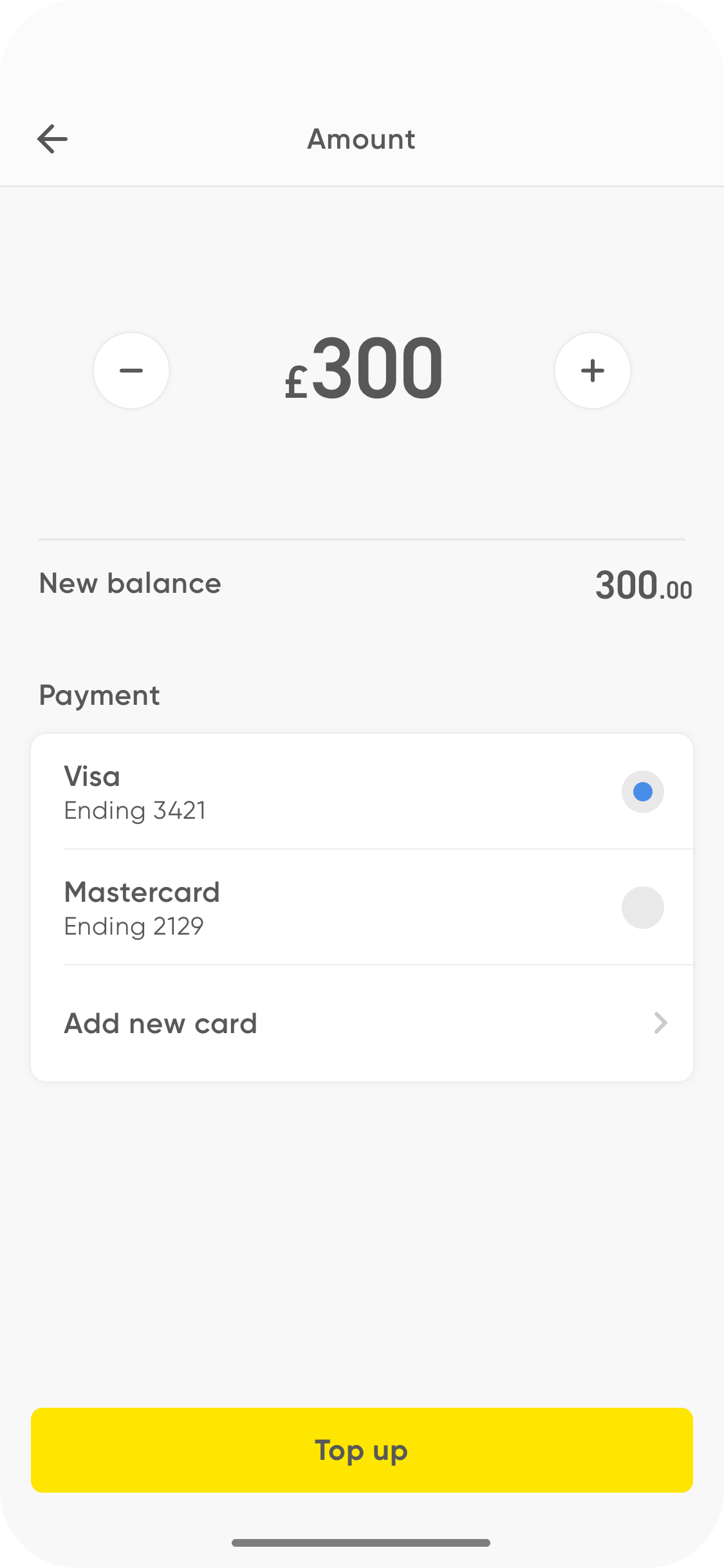

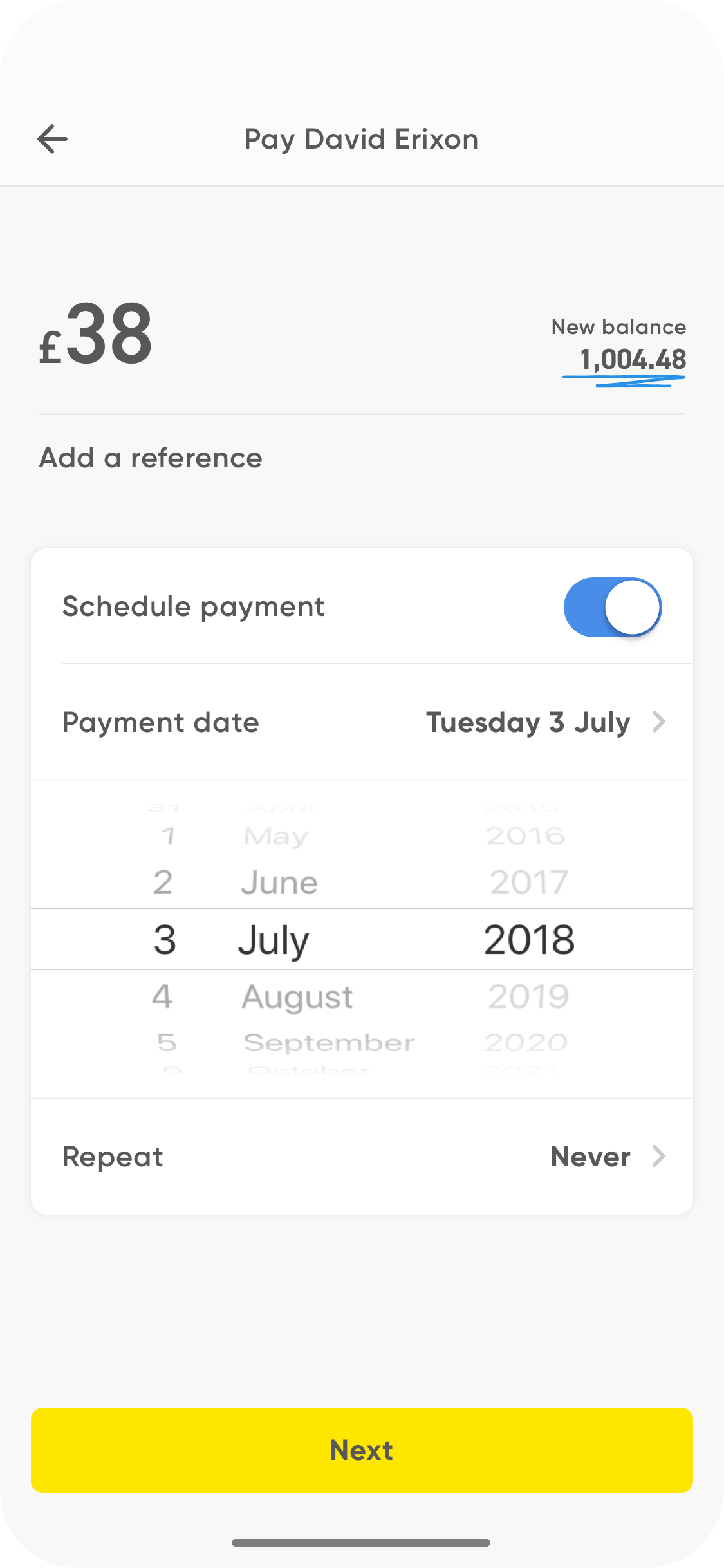

Top up or pay someone

Payments of any kind are simplified to a few steps. Simply choose a payee, tap in the amount, confirm with native device security and your payment is complete. Options to add a message or control frequency are available.

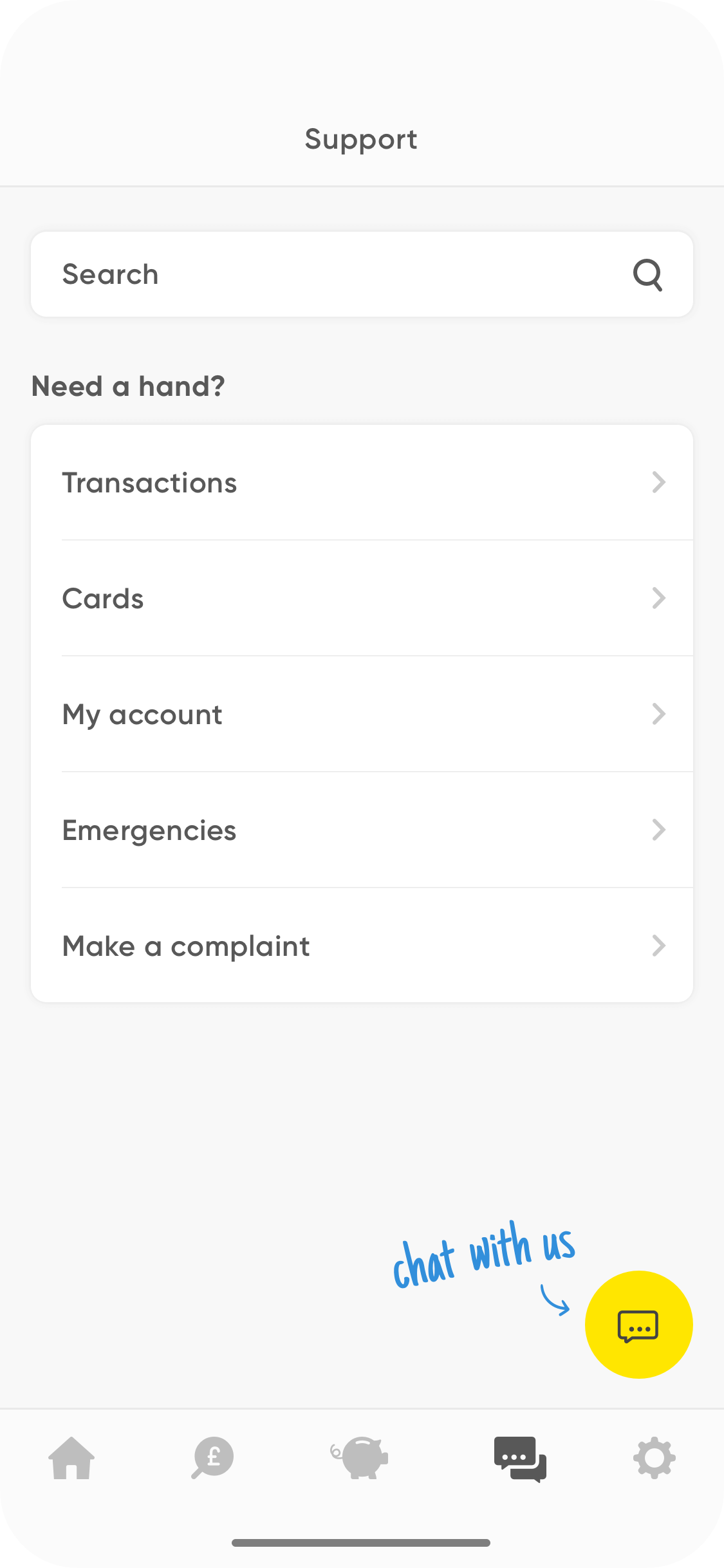

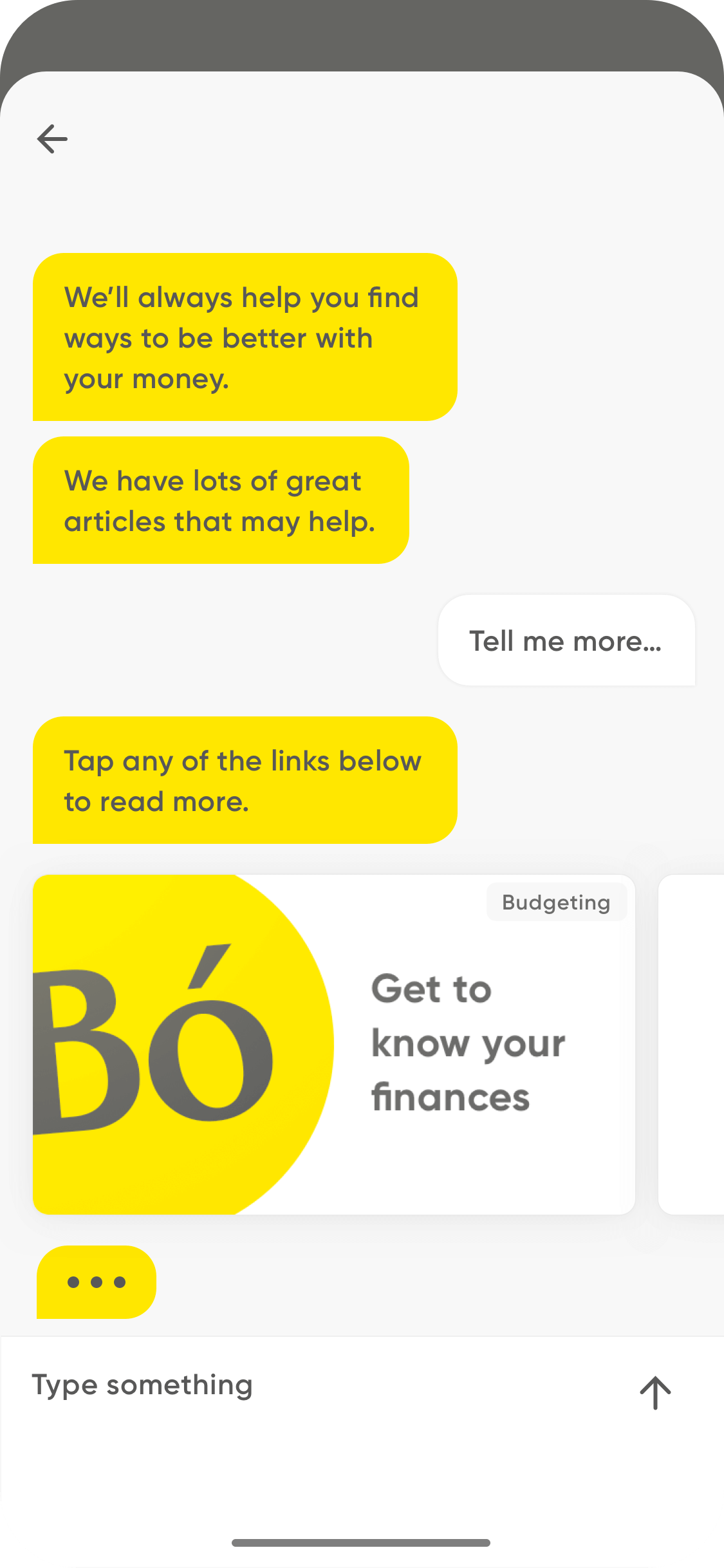

Support

Always available

Bo is a mobile only bank which means the cost of running it is far lower than a traditional bank. This is great news for customers. With less pressure to capitalise on selling products, Bo can concentrate on helping customers do money better.

With round the clock support directly from your phone, Bo is always on hand to give personalised support.

Building a brand

A differentiated brand in a saturated market

Being on the side of the customer means helping them understand what is important. With inspiration drawn from budgeting the analogue way - pen on paper - Bó guides the customer with a blue line drawn over the interface.

Looking ahead

The northstar

The MVP serviced core requirements of our customers and has now been launched to begin helping the 47% become more aware of their money.

To help picture the future of this evolving service we created a northstar vision that could truly deliver our proposition of helping people do money better.

Overview

Personalised insight hub

A dynamic dashboard that surfaces the most relevant information to the customer any time they open the app. Housing mini bite-sized experiences that give personalised insights about spending behaviours.

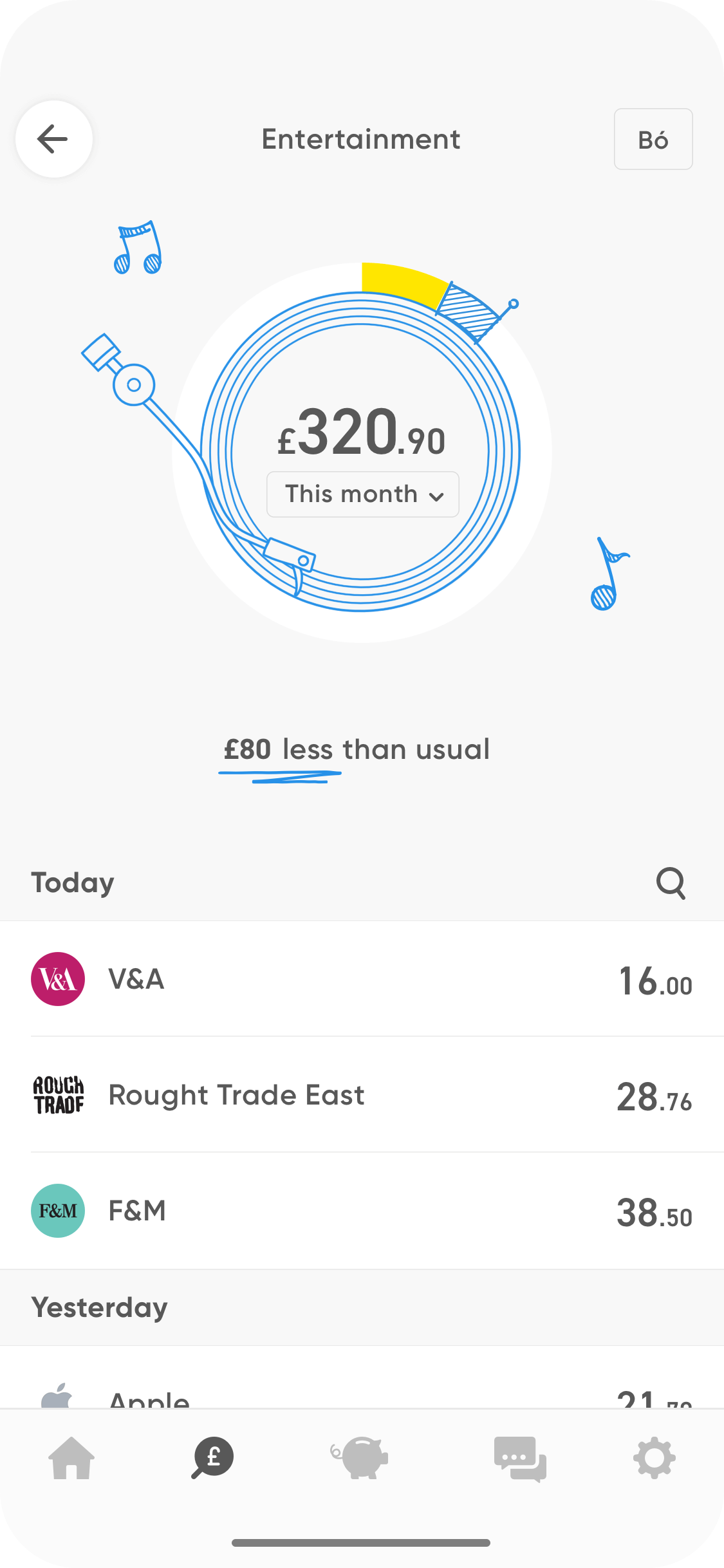

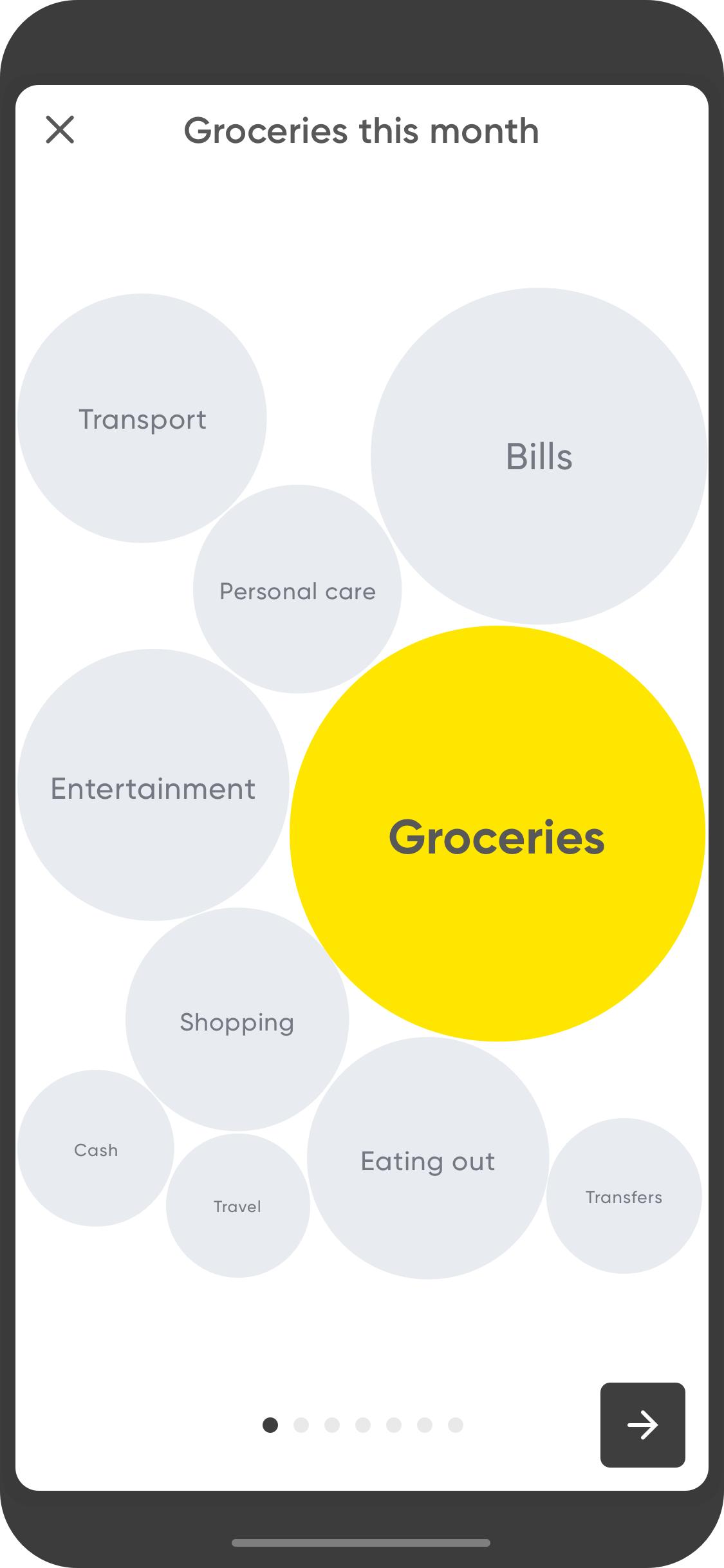

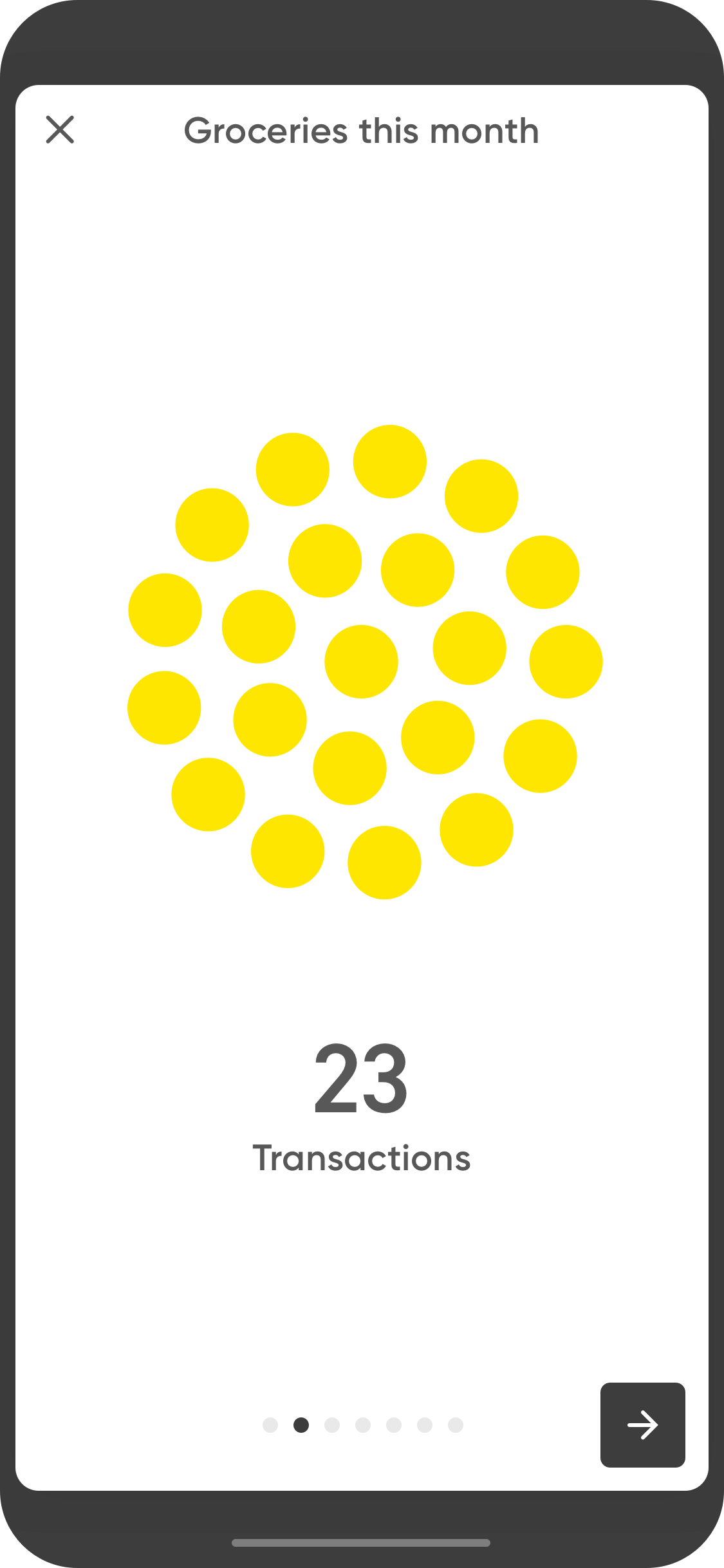

Spotlight

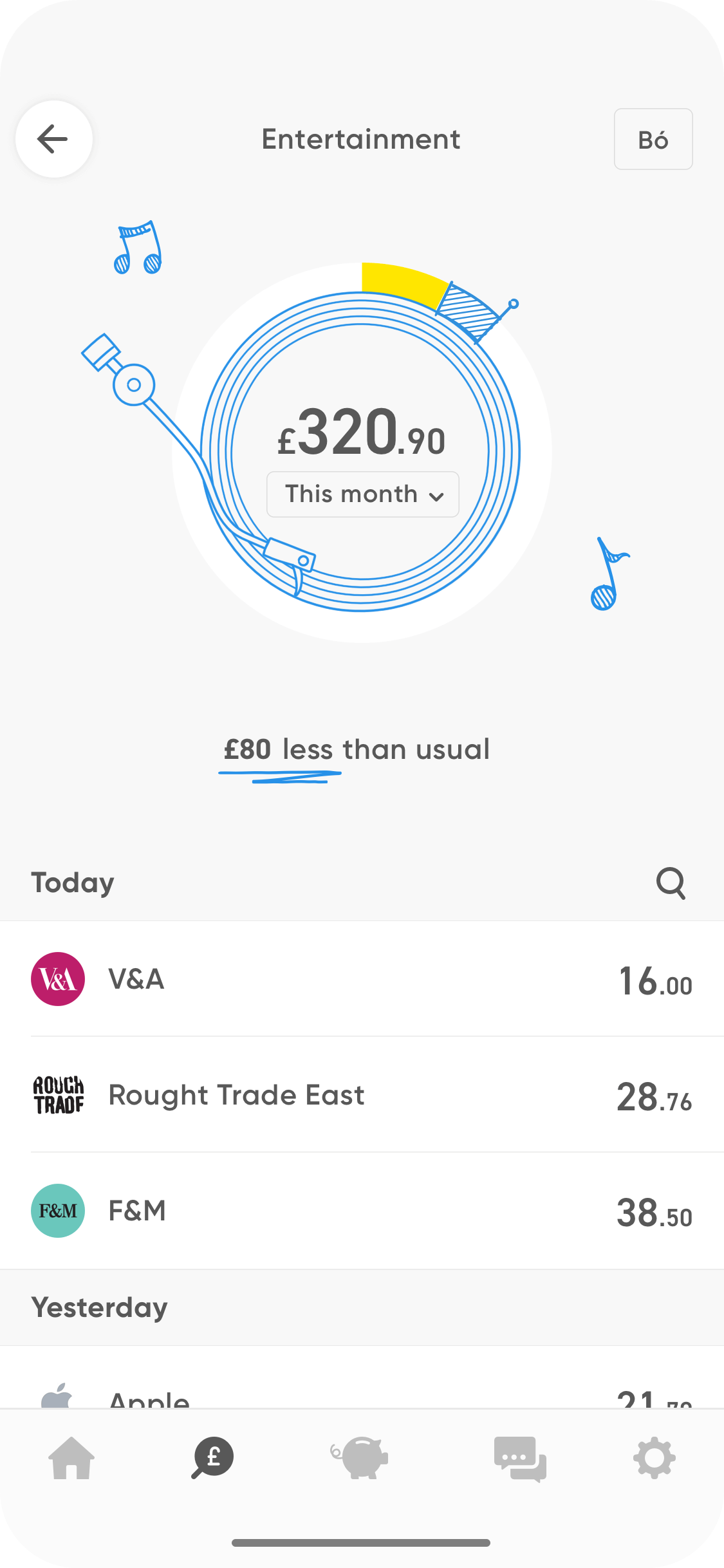

Category report

A mini-experiece is promoted on the dashboard to shine a spotlight on specific category spending behaviours of that week. Here the information is broken down into simple statistics accompanied by visual representation to break down the information in a really digestible way.

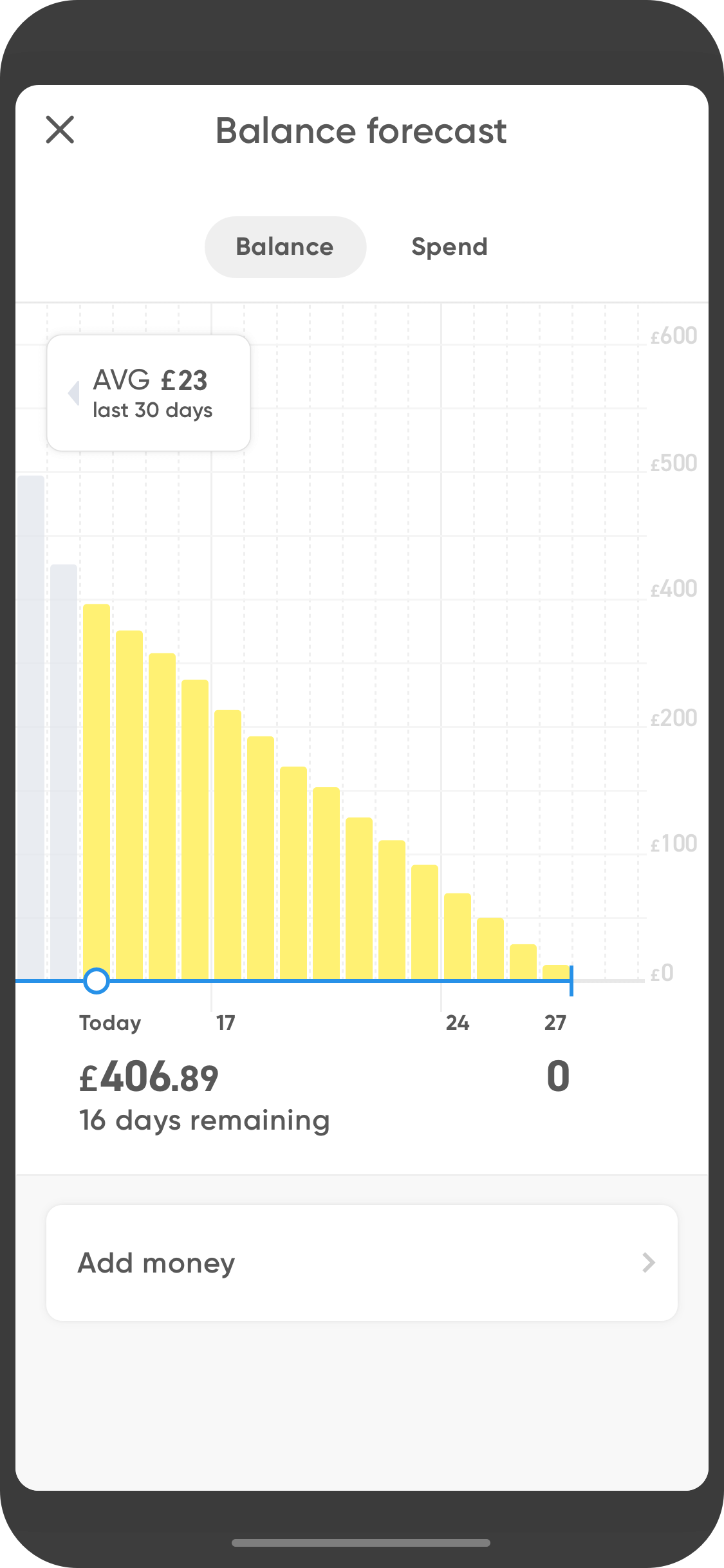

Reports

Detailed analysis

Here customers can also access a more detailed view of their spending behaviours. Bó also keeps track of your average spend which means over time it gets a more accurate view of how long your money is likely to last. This can be viewed int he balance forecast module.

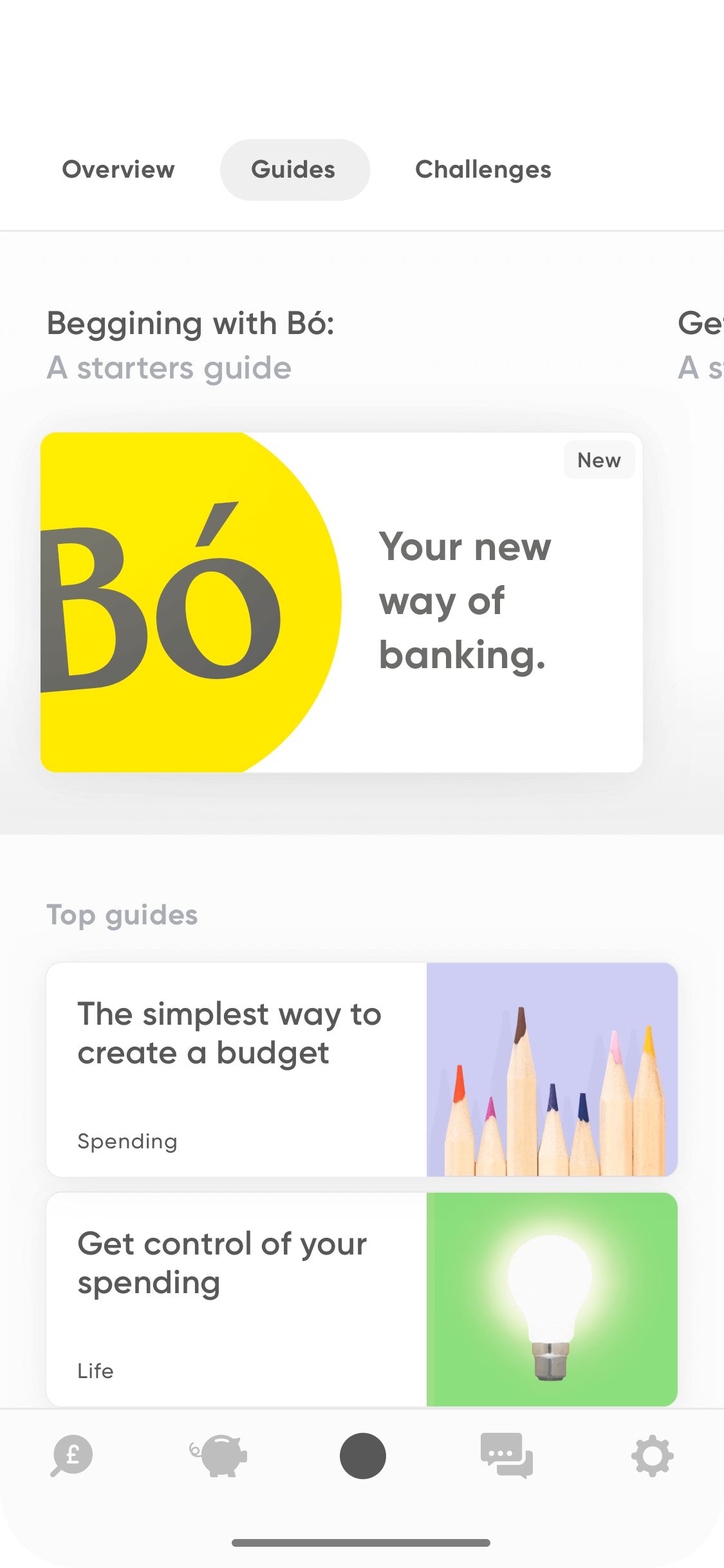

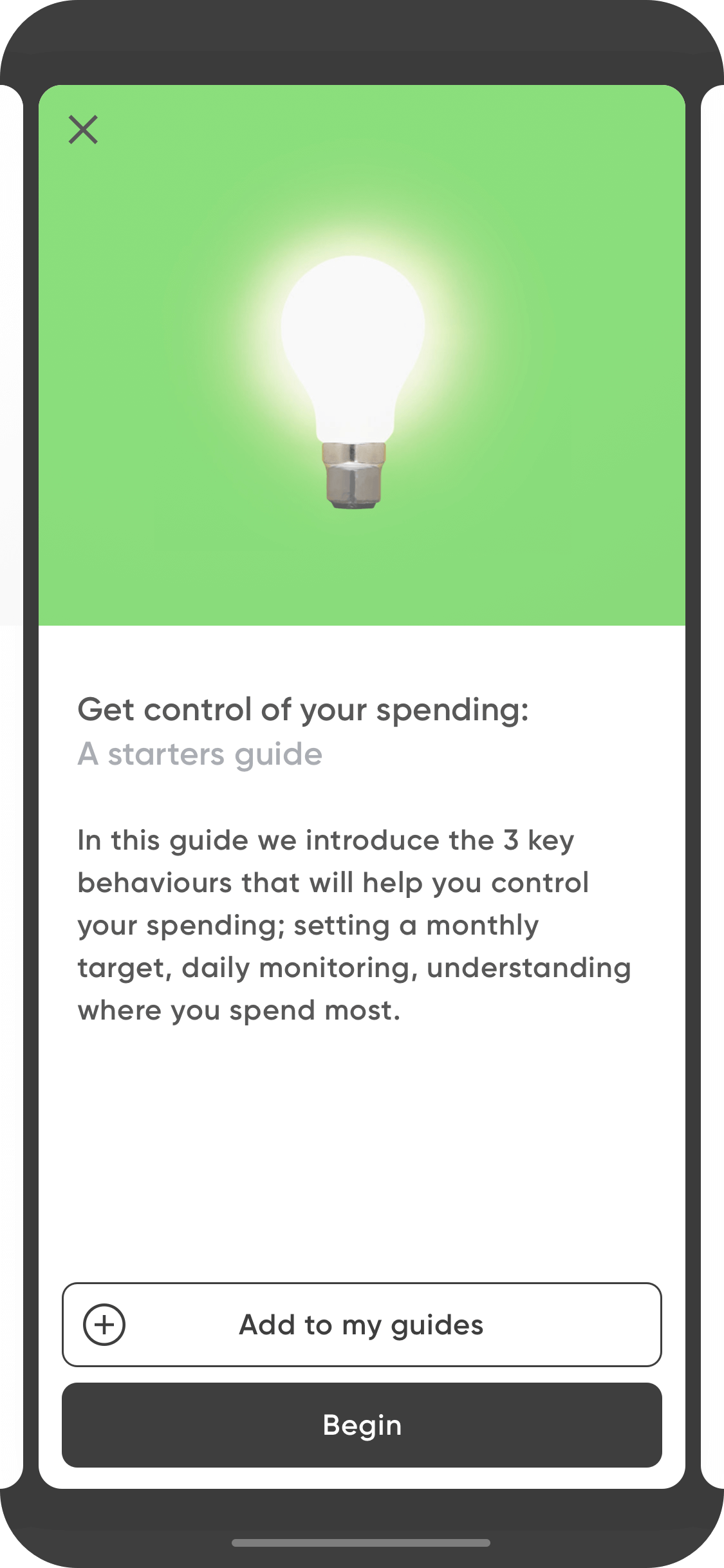

Guides

Helping people do money better

The guides tab houses packages of content designed to help the customer do money better. These range from advice about saving money on bills to changing energy suppler to articles about shopping smart or setting budgets.

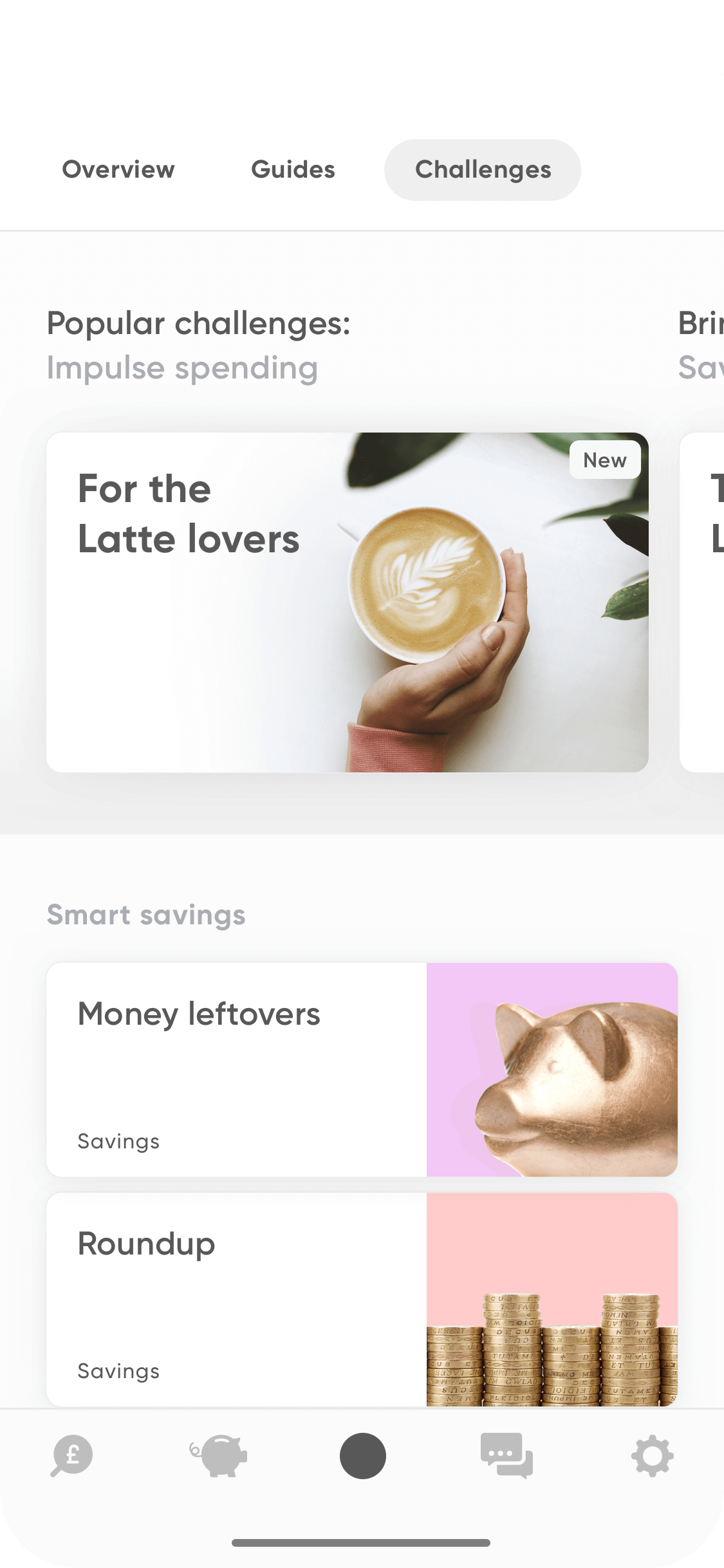

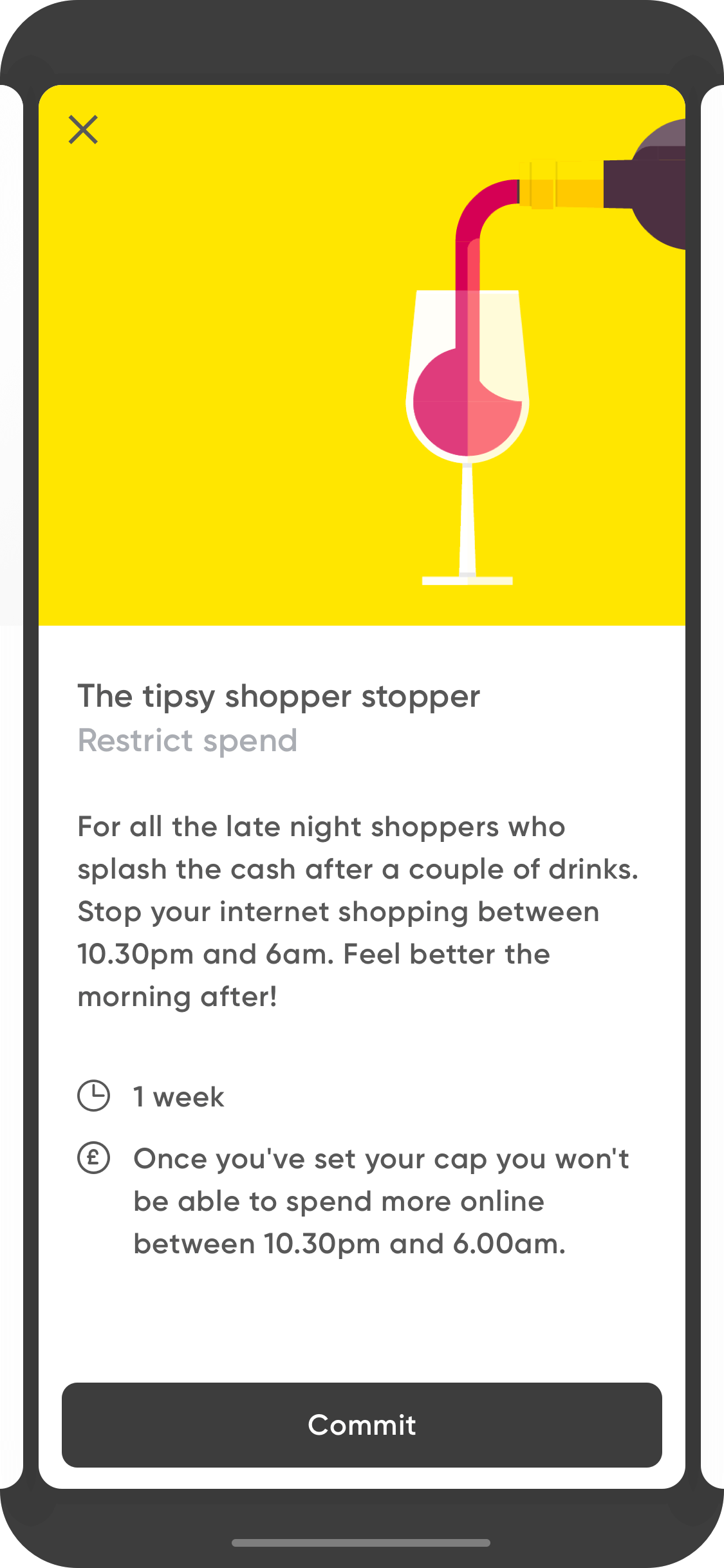

Challenges

Light touch gamification

The final tab houses an array of “if this then that’ rules which automate your account in ways that either limit spending or move money to savings when an action is taken. This works in conjunction with VISA’s API.